The stimmy and "rebuild" play with industrial metals.

TheMacroDrip is a newsletter that goes beyond a company’s fundamentals and financials. We look at the market as a whole for investing ideas that span over various asset classes. If you are reading this and have yet to subscribe, then join us below to receive weekly updates directly to your inbox.

Last week we covered commodities - agriculture. Today we’re going to look at another side of the commodities investment - metals & industrial materials. This is a continuation of my report on inflation hedges, and although most commodities took a beating after last week’s J. Pow interview, this industry is highly cyclical and it is my belief that the trend is still UP.

Recently we’ve seen lumber prices somewhat revert back to “normal”, here’s a look at a few other commodities.

Before we get into anything, remember that there are four main categories of metals. These four are:

Industrial metals: The main usage ones that include copper, iron, nickel, zinc.

Precious metals: Gold and silver gang.

Nuclear energy metals: Uranium and plutonium.

Rare metals: Neodymium, cerium, etc. This list is long.

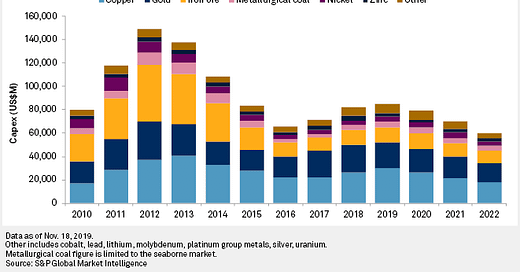

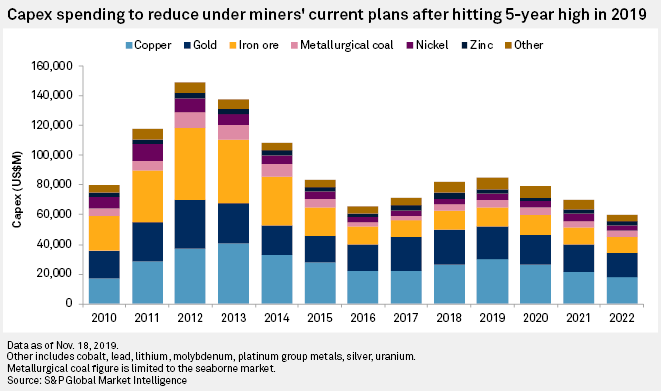

We don’t need to know the functionality of each metal, but it helps to acknowledge the groups and understand what their use is. Similarly to the late 2000’s, the end of the previous bull market in commodities led to a large underinvestment and capital expenditures (CapEx) in the sector. History often rhymes and as we’ve seen before, underinvestment in this sector will lead to the next bull run. In 2020 alone CapEx in mining companies dropped roughly 12%. Here’s a chart by SPGlobal that was done in 2019 (pre-covid), it shows the downtrend in CapEx in the mining industry and where we were headed by 2022.

From the peak in 2012 and 2013, CapEx in the mining industry has been nearly cut in half. Adding to a constrained supply, exploration and development of new sources has been cut. The tide is about to turn.

Whether or not inflation is “transitory” is the great debate at the moment and valid arguments could be said from both sides. The Fed has noted that there are very specific sectors that are contributing to the uptick in CPI, mainly led by used car sales and re-opening plays (hotels, travel, restaurants, rental cars, etc). In most cases there has been pent up demand in these industries and rising prices have been exacerbated by supply chain issues. Is this all just short term, or “transitory”, as the Fed would say? It is quite possible, but I don’t see supply meeting demand within the next few months, this is likely something that might go on into 2022.

I see several factors that lead me to believe this bull run in commodities is just getting started. Here are some bullish events that have drawn me to this conclusion:

Global Growth & Cyclical Demand: The pandemic has shocked most economies and one of the traditional ways most countries try to stimulate is by building back better. Infrastructure projects galore in the public sector will aim to relieve unemployment, boost spending, and have a stimulatory effect on GDP.

Transition to Clean Energy: Biden re-iterates his infrastructure plan, which is largely focused on the clean energy movement.

Dollar Depreciation: Lower interest rates and infinite amounts of government spending could lead to a weaker dollar. It makes sense for rising commodity prices when you can buy more with a cheaper dollar.

Supply Chain Issues: The commodities complex has been starved of capital for some time. Combine that with supply side issues and lower demand from shutdowns and higher prices are an inevitable outcome.

Risks

One particular risk I wanted to focus on was China recently announcing they will be selling metals from their reserve in an effort to cool the surge in commodities and pushing prices back to a normal range. This could be legit, but it might also be the Chinese government looking to offload some of their inventory at almost peak prices.

Another is the fact that the dollar may not depreciate as we might expect and inflation does cool off.

Final Thoughts

What I like about this play is that there are several bull cases that could continue to push prices up even if “transitory” inflation turns out to be one giant nothing burger. We have many industries putting pricing pressure on commodities and this bull cycle may very well last for some time. Backed by most governments the green economy is receiving widespread political support which is more likely than not going to be a long-term theme. Personally, I have increased my exposure to areas that agree with this clean energy transition which include commodities like copper, nickel, energy companies, and even Uranium.

How can you play this? Here are a few companies that have been on my radar.

Rio Tinto (RIO) : Iron ore and copper.

Vale (VALE) : Ferrous Minerals, Base Metals, and Coal segments.

Southern Copper (SCCO) : Exploring, mining, extracting of copper resources.

ArcelorMittal (MT) : Steel mining and manufacturing.

Cameco (CCJ) : Uranium energy.

The list can go on quite long actually, but some of my plays would include some industrial metals, mainly steel, iron, copper, mixed in with some energy plays either green energy or long-term uranium energy companies.

Good luck to all and always remember to do your own due diligence before investing in any of these stocks.

If you liked this post from TheMacroDrip, why not share it?

Disclaimer: This is not financial advice or recommendations on any investment. The content is for informational purposes only, you should not construe any such information or other material as investment, financial, or any other advice. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. Trading equities can be risky and lead to a loss of capital. You are solely responsible for the investment decisions you make.