Investing in Crypto assets by proxy - Coinbase

TheMacroDrip is a newsletter that goes beyond a company’s fundamentals and financials. We look at the market as a whole for investing ideas that span over various asset classes. If you are reading this and have yet to subscribe, then join us below to receive weekly updates directly to your inbox.

When Coinbase went public via direct listing I did not like the valuation given all the surrounding hype in crypto-currencies. At current levels and Coinbase (COIN) priced at $225, I do like this stock. In my non-professional opinion, if someone wants to ride the hype around Bitcoin without experiencing the large swings and volatility, Coinbase may actually be somewhat of a proxy play for the industry. Remember that Coinbase makes 95% of their revenue through transactional fees, and not through the alternative assets price. High volatility within the assets is very much business positive as will be confirmed by their most recent earnings.

A store of value - Or is it?

The rise of crypto-currencies and mainly their use as a speculative asset has been criticized at each step on the way up. Some may argue that crypto is not truly a “store of value”, but we need to look at what value really is. Does artwork hold value? Why would some art pieces sell for 10 million dollars while others 5 thousand dollars? Technically they are both the same thing -a painting on a canvas.

When I look at crypto currencies I see a lot of speculation. They are indeed a store of value, but that is highly dependent on the price. Bitcoin, trading at roughly $37k-USD, definitely has value. Was the value over-stretched at $60k? Maybe. Would people buy a lot more of it at $5k if they had the opportunity? I’m sure the answer would be yes. Like Gold, the actual value of Bitcoin will never change. 1 Bitcoin today will still be 1 Bitcoin 10 years from now, just as 1 ounce of gold will also be the same. What changes then? Simply the perceived value of the asset. Like I mentioned earlier, value is only what someone is willing to pay. Unlike Bitcoin and other crypto-currencies, Coinbase is a growing business that generates actual cash flow and causes value to adjust over time.

Use Cases

One issue that comes up often is that you can’t actually do anything with a crypto currency… At least not yet. At the moment, most of it’s use comes from trading purposes in hopes of getting in and out at better prices. The end goal would be a true democratization of financial markets with real-time cross-border payments, and a digital marketplace where you can actually use the currency (I’m talking about more than just buying NFTs).

Coinbase - Business Overview

Coinbase has a significant network advantage from their early-mover status. They are also the default starting place for many customer’s adventure into the crypto scene, even more-so now after the exposure they’ve received from their direct listing and being publicly traded. Coinbase is a growing business. In Q1 2021 they saw explosive growth, nearly 30% user acquisition QoQ from Q4 2020.

This user growth has led to over 1,000% increase in trading volume among retail and institutional buying. This was most interesting for me because it demonstrates institutions are starting to buy these assets (large quantity, long-term holds).

Here’s a quick look at their increase in transactional revenue, which is in-line with the increase in trading volume.

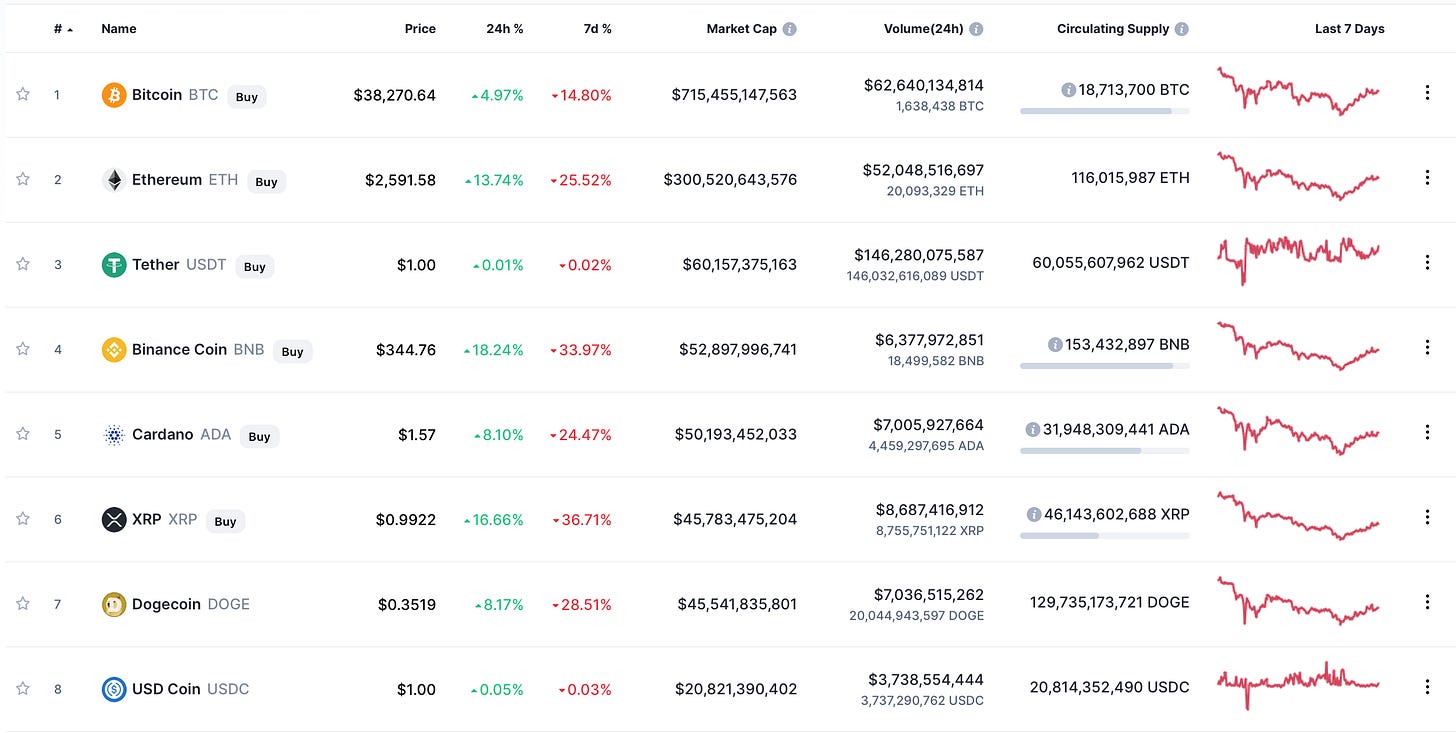

The fact that Coinbase offers a diverse variation of trade-able cryptos does not necessarily mean much. Investors will be sticking to the more notable ones (BTC, ETH, Tether, DOGE). Here’s a current list of some of the top coins in the space.

Lastly, Coinbase’s user acquisition will come with customer acquisition costs (CAC), which generally entail offering incentives for users to join, and other heavy marketing costs. Being one of the top exchanges at the moment has allowed them to capture from this explosive growth in the crypto scene. Competitors who are only getting in now will be fighting an uphill battle and have already lost first-mover advantage.

Bear Case - Risks

There are some risks involved that could be looked at the macro level of crypto as a whole and also risks associated with Coinbase’s business model. I’ll go through some.

Risks - Macro

Regulations: The crypto industry is already being taken hostage to different laws, regulations, and policies. Who’s to say that other governments won’t be following suit by banning crypto currency as a form of payment?

Government & Taxation: The U.S Treasury has called for stricter crypto compliance with the IRS, stating that any transfers greater than $10k USD will need to be reported.

Global Crypto Demand: Crypto-currencies have gained a lot of popularity recently. Since Coinbase makes nearly all of their revenues from transaction fees this would require not only for demand and popularity of cryptos to be maintained (or continue to grow), but also might face pricing pressure as more competitors enter the space.

Risks - Business Model

Competitor Pricing Pressure: Going back to Coinbase and new competitors entering the market, a platform based strictly on fees alone would be held at the mercy of any competitor with deeper pockets creating pricing pressure on this business model. Similar to what Robinhood did to other brokerages by making trading free. Coinbase CEO has stated that pricing pressure from competitors has yet to be a factor in their capturing of market share.

Innovation & Capturing Audience: Coinbase would need to stay innovative with their product. From application design, to customer acquisition, and marketing costs, their entire product revolves around grabbing users and keeping market share.

Customer Churn: Coinbase needs customers to continue to trade the currencies. Due to crypto being extremely volatile by nature this could cause losses for a lot of their customers. There’s a possibility user growth and transactions may decline as traders lose money in the markets.

Share Dilution

Coinbase currently has 217 million shares outstanding and on it’s way to approx 260 million shares outstanding (another 43 million of share dilution). The shares are nearly fully diluted, for the time being, but we can still expect to see another 20% come to the market. The concern of many investors is the perception that management are all cashing out on the direct listing, but that is usually the case with any company that becomes publicly traded. Early investors have been waiting years for the opportunity to finally cash out.

Final Thoughts

Personally, I don’t like investing in crypto assets due to their volatility and wide price swings. That doesn’t mean that I don’t think they will continue to grow in popularity. Investing in Coinbase is somewhat of a crypto proxy that provides tangible value and growth. It is easier for me to allocate 1-3% of my portfolio to COIN instead of the same percentage into BTC or ETH. A lot of crypto investing is based on speculation, ie: “Will they get regulated”, “Will the BTC price explode to 100k”, “Will big whales continue to invest”. There are a lot of “what-ifs” in this industry which make it a high-risk, high-reward play. After this nearly 50% drop from the high, COIN’s valuation is in a more reasonable range to allocate a small position.

If you liked this post from TheMacroDrip, why not share it?

Disclaimer: This is not financial advice or recommendations on any investment. The content is for informational purposes only, you should not construe any such information or other material as investment, financial, or any other advice. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. Trading equities can be risky and lead to a loss of capital. You are solely responsible for the investment decisions you make.